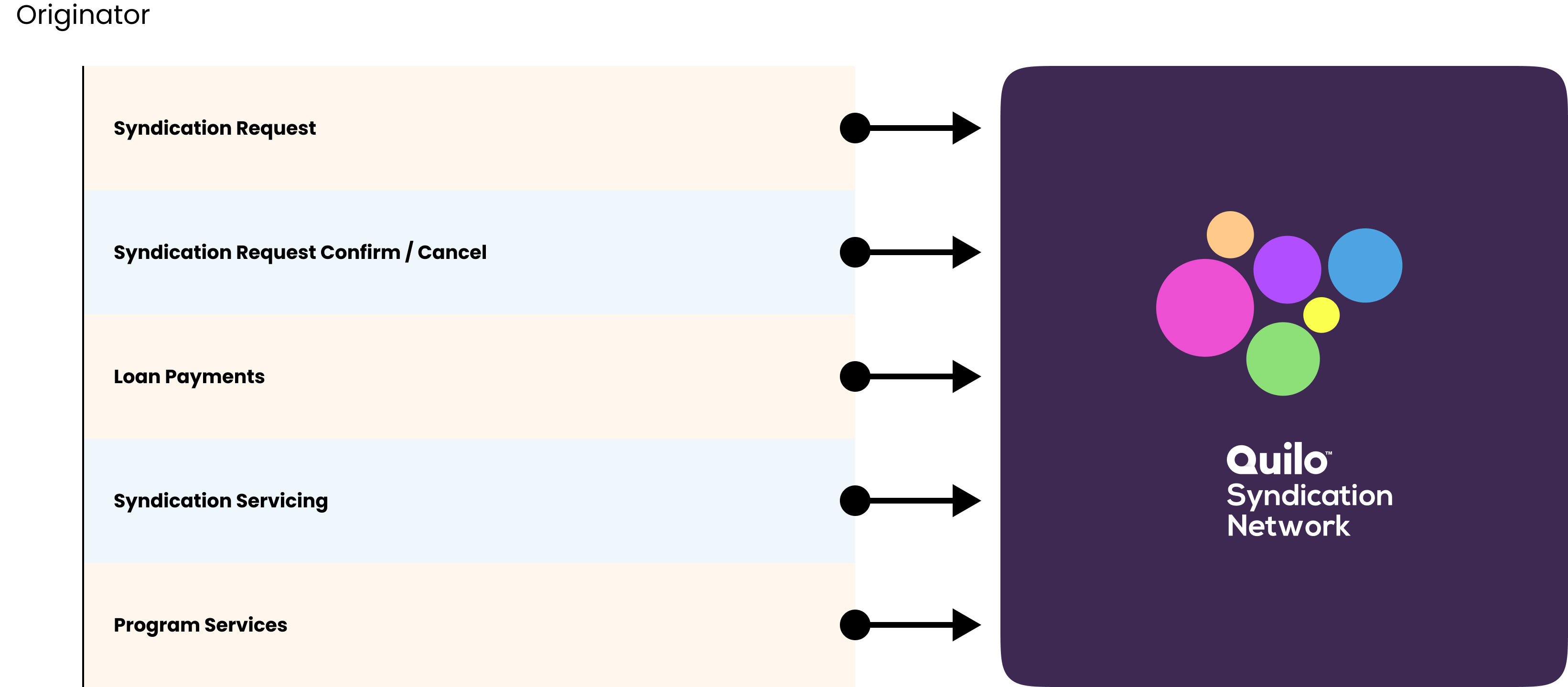

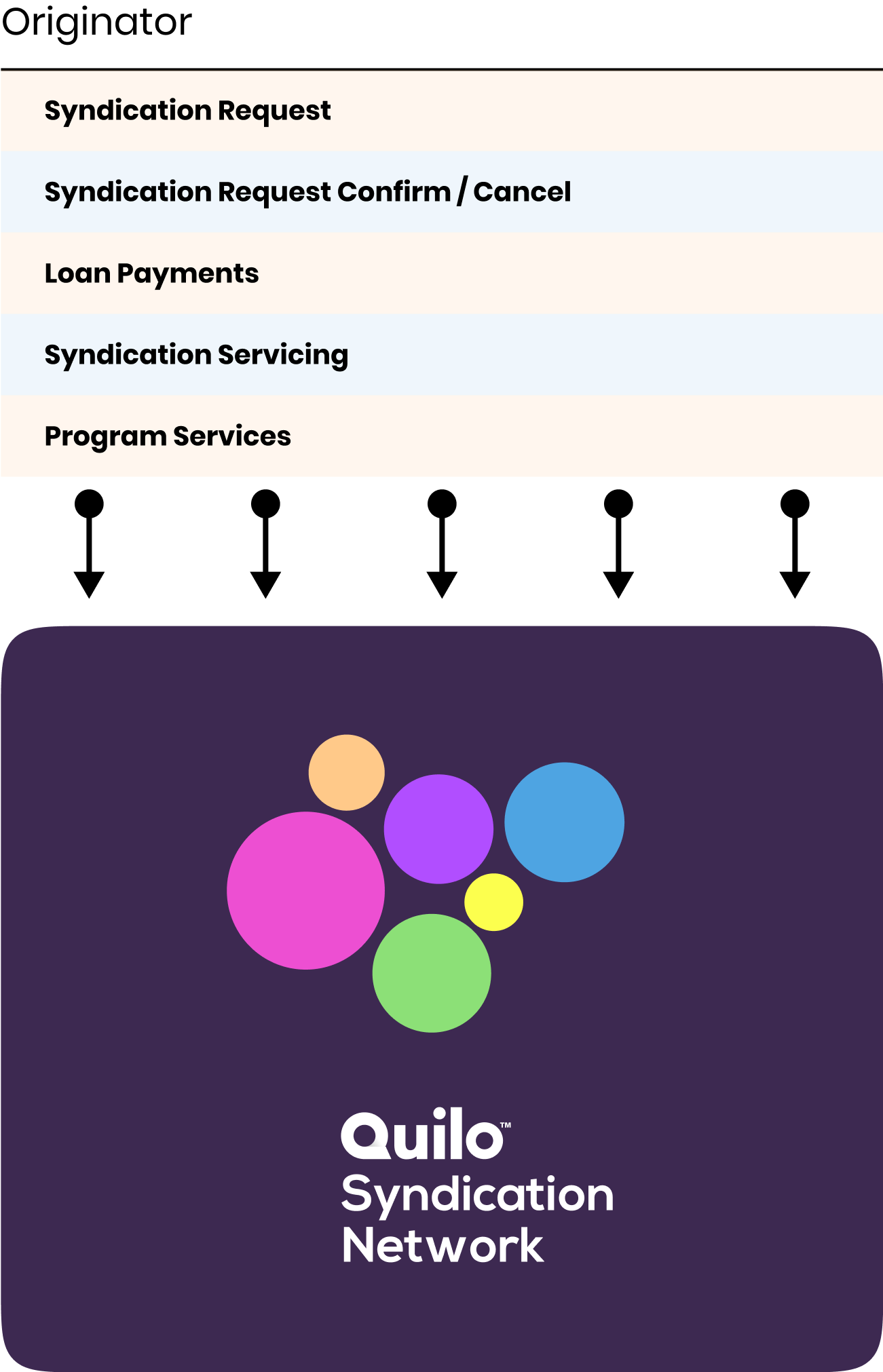

It's easy to connect your loan flow for guaranteed, on-demand, real-time syndication with Quilo API.

is a financial institution that buys some interest in an individual loan

is a set of lending features that constitutes a lending product - e.g. Unsecured Personal Installment Loan, New Car Loan, Used Car Loan, Line of Credit, RV Loan, Boat Loan, etc

is a set of criteria defined by Participant for participation in a specific program. Each Program may have its own set of criteria

A Participant may participate in one or more Programs

A Participant must set and maintain separate Funding DDA account for every Program they participate in at their own institution

a Participant will set and maintain daily participation limit for each Program they participate in

is an account that covers Daily Program Participation Limit. It's a virtual account at a third-party Custodian Bank that Quilo is authorized to Direct Debit to cover Participation Settlement in case the Program Funding DDA direct debit has failed

a dedicated DDA account Participant sets at its own institution to settle participation

is an external, real-time loan originator inquiry issued to Participation Network to request up to 100% participation in a specific loan. This request must contain sufficient information about applicant, loan terms and participation requirement. Upon sufficient Participation allocation, a Master Participant will receive time-limited confirmation that guarantees participation

is a set of rules that are designed to offer fair opportunity to participate in loan flow to every network participant

is a set of criteria and metrics that define the Participation Queue including actual Portfolio Quality, Maximum Term, Maximum Tier Limit, Participation Factor (percentage of daily limit that has already been participated), cut-off credit score and finally Commitment Factor(a portfion of a daily limit a Participant committed into the a pool of commitments among selected participants) and dozen of others